35+ should i buy down my mortgage rate

Web Year 1. Ad Calculate Your Payment with 0 Down.

Should You Pay Points To Buy Down Your Interest Rate Youtube

Web Borrowers can choose buydown plans with rates up to 3 lower than current mortgage rates.

. If you can lower your interest. Web Purchasing mortgage points AKA buying down the rate will lower the mortgage rate which means youll pay less interest each month and over the life of your loan. Web Buying down your rate means paying for mortgage points at the start of the loan to lower your rate.

Web And the rate of 6375 actually results in a lender credit which is the opposite of a buy down because you get money back to cover closing costs. By buying these points you reduce the interest rate of your loan typically by 025 percent per point. Web A 3-2-1 mortgage buydown offers an interest rate 3 lower than the average rate at the time.

For instance if rates are averaging 6 for someone in your. This strategy usually works best for someone who will be in the. For example if market rates are 5 a 2-1 buydown would allow you to.

Web Use our free mortgage calculator to estimate your monthly mortgage payments. But once the buy-down expires your bills. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web The number of points you pay should come down to how much cash you have on hand to cover the higher closing costs versus how much you want to lower your. Short answer is no you could use that money for a few months of mortgage payments and stream line re-fi when. If you really need cash fast the company offers closings in as little as seven days.

Account for interest rates and break down payments in an easy to use amortization schedule. Ad Compare Loans Calculate Payments - All Online. You can deduct mortgage interest on up to 750000 worth of your home loan or 375000 if youre married and filing separately so.

Today well discuss how to know if its a smart choice or not. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford. Web Are mortgage points tax-deductible.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Total savings for buyercost to. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Web Each point typically costs 1 percent of your loan amount and lowers your rate by about 025. 250000 Original interest rate. If the down payment.

Web Same question different day Should you buy down your rate. Ad Compare Loans Calculate Payments - All Online. Check How Much Home Loan You Can Afford.

55 mortgage rate with a 2271 monthly payment. Web This chart shows how the monthly payment and the interest change at different rates on a 250000 30-year fixed-rate mortgage. HomeGo buys a lot of homes for cash one every 20 minutes according to its website.

Web Estimated monthly payment and APR calculation are based on a down payment of 25 and borrower-paid finance charges of 0862 of the base loan amount. Find The Best Options for Buying a Home. Web Estimated monthly payment and APR calculation are based on a down payment of 25 and borrower-paid finance charges of 0862 of the base loan amount.

Web In effect mortgage points are a type of prepaid interest. Here are some of the factors you need to consider. Web A buy-down will offer homebuyers a lower monthly mortgage payment for a set period of time typically one to three years.

Ad Increasing Mortgage Payments Could Help You Save on Interest. But if you want a rate of. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

If the down payment. Check How Much Home Loan You Can Afford. Save Money With Lowest Rates 2023.

Web Buying down your rate means youll pay a one-time upfront fee for a lower interest. Ad Compare Top Mortgage Lenders 2023. Web - SmartAsset Trying to decide whether to put your money toward investing or paying down your mortgage.

Read on to find out more. 65 mortgage rate with a 2528 monthly payment.

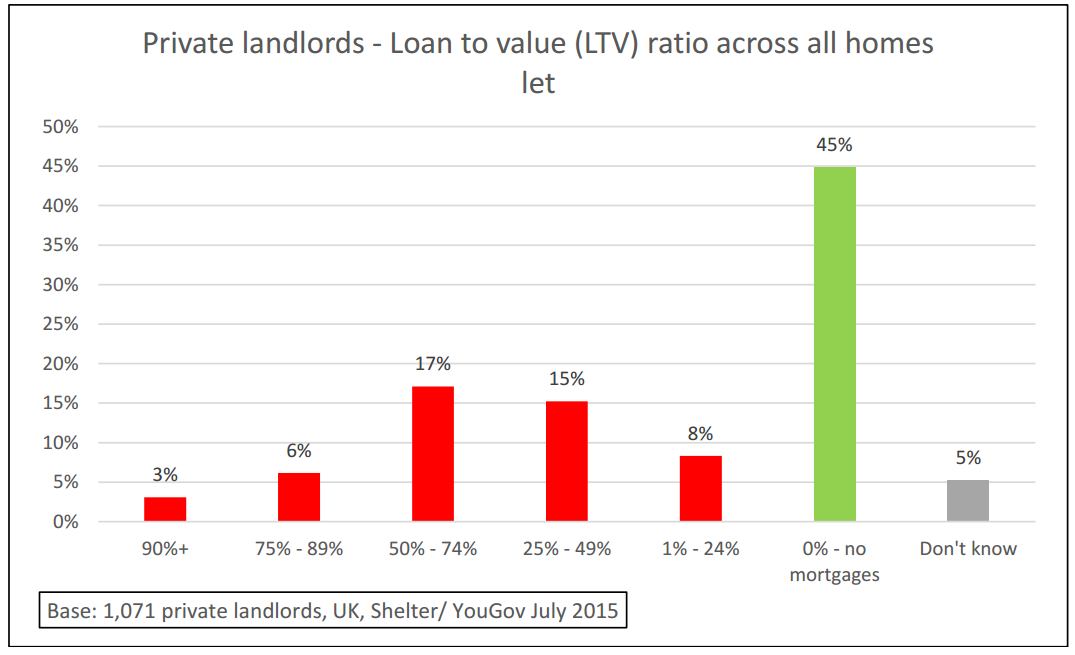

Debate Around Buy To Let Tax Changes Points To General Need For Extra Safeguards For Tenants Shelter

Average Down Payment For A House Here S What S Normal

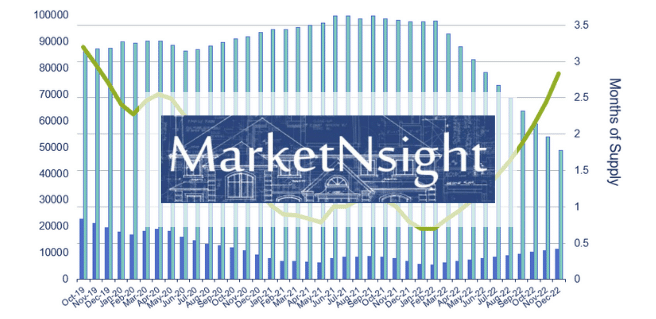

Will Rising Interest Rates Kill The Housing Market

Should You Buy Down Your Mortgage Rate Pros And Cons

Choosing Mortgage Terms In 2023 Wealthrocket

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

When Mortgage Rate Locks Expire Mortgages The New York Times

Should I Buy Down My Mortgage Rate Penfed Credit Union

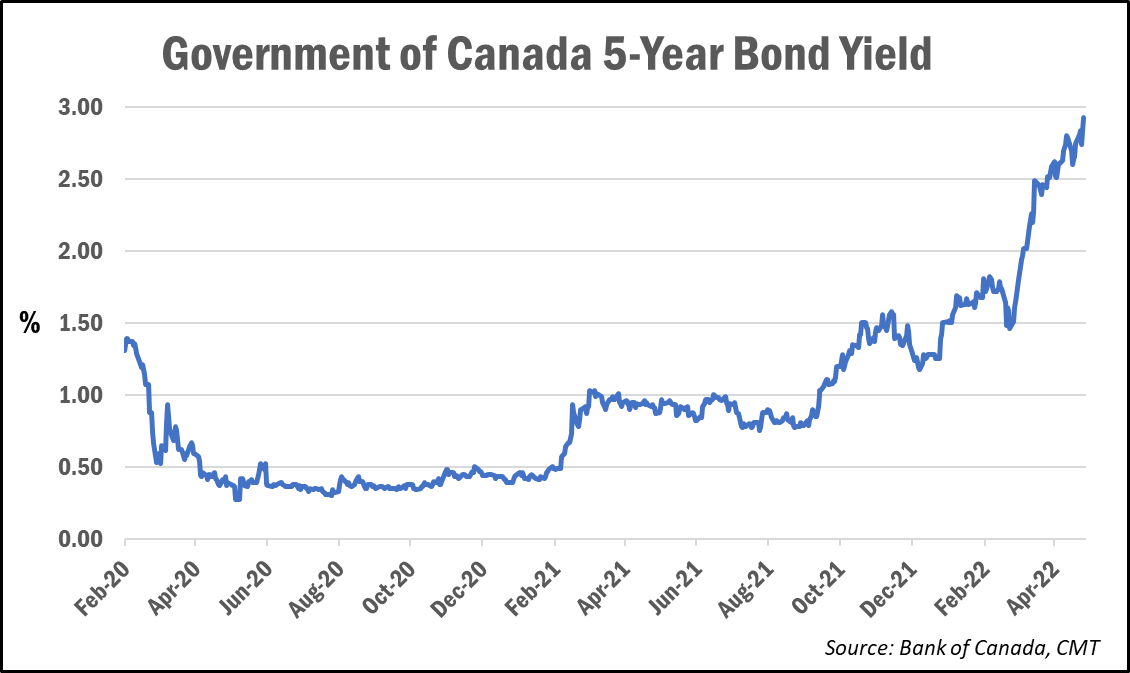

The Latest In Mortgage News Cmhc Sees Chance Of A Recession If Boc Policy Rate Hits 3 5 Mortgage Rates Mortgage Broker News In Canada

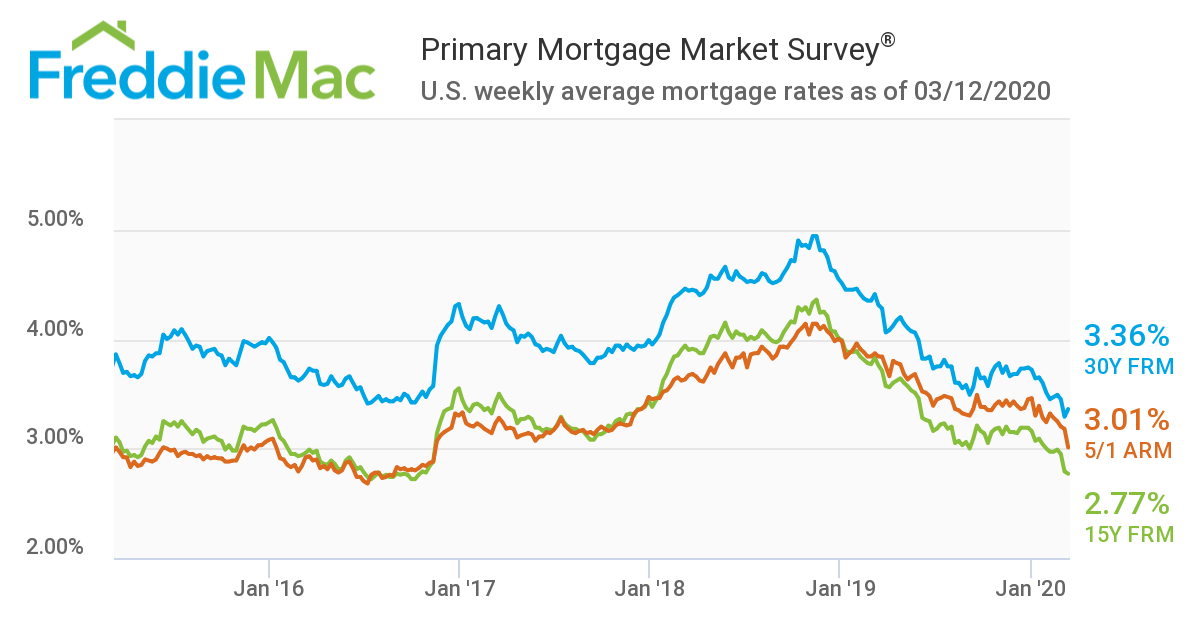

What Is A Mortgage Rate And How Do They Work Credible

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street

Home Appraisal And Your Property Value

Should I Buy Down My Mortgage Interest Rate Salary Optional

Buydown A Way To Reduce Interest Rates Rocket Mortgage

Lenders Hike Fixed Rates Yet Again Bringing Them Closer To 4 5 Mortgage Rates Mortgage Broker News In Canada

Interest Rate Buying Down Your Mortgage Rate Jeremy Kisner

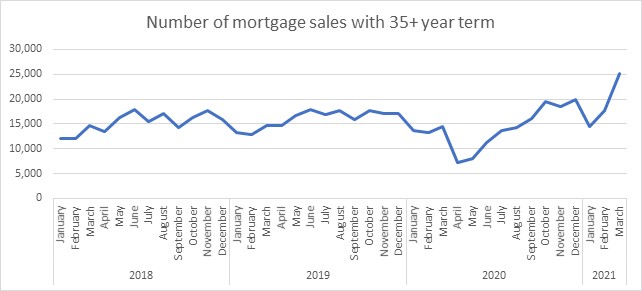

New Data Shows Stark Increase In Mortgage Sales With 35 Year Terms Quilter Media Centre